Howard and Switkowski's legacy was a deeply damaged and uncompetitive business palmed off onto naive investors. The Telstra share price was performing a "dead-cat" bounce and didn't recover until the NBN Co agreements were signed.

Since the 2013 election, it has continued to increase in value, but not noticeably faster.

See page 6 of the Telstra 2014 Annual Report [PDF] for the public status of their current NBN Co negotiations [and a summary on-line]. There is no public information to suggest timing, no we're not "close".

See the Share Price discussion and graphs below. Telstra's lowest price was immediately prior to their announcement of the Definitive Agreements with NBN Co.

- There was no mention of Ziggy being a twice failed CEO of Telecomms firms, or that under his control, Telstra's value went into unchecked decline while $5 billion of his acquisitions were written off, plus Sol Trujillo estimated that there'd been $2B-$5B of under-investment.

- There is no new deal with NBN Co. Not yet and not soon, from public information.

- Telstra's share price has hit a 12-year high. Higher than under Ziggy as CEO.

- The Telstra share price has been increasing, ever since the definitive agreements with NBN Co were announced around April 2012 and signed in June, 2012. Before, they were in unchecked decline, which you wouldn't know from Maiden's piece.

- The Copper is not solely a stranded asset, access to it and the ducts & lead-ins is necessary to deliver an FTTN. As Alan Kohler pointed out in 2012, Turnbull is over a barrel with the FTTN. This is very different from the Quigley FTTP deal, where NBN Co had other viable options, they could've run Fibre themselves, paying Telstra nothing.

- "Kept Whole" is an undefined term. Telstra's definition will be unique and to the advantage of its shareholders. Telstra never shared the full terms of the first Definitive Agreements, only released a "post-tax Net Present Value" aggregated value of $11 billion.

- Thodey very well knows that the rollout of an FTTN and disconnection of Exchanges will take time and it will takes decades to finally shut down the remaining Telephony Copper Customer Access Network.

- During all that time, someone will have to be responsible for full and proper maintenance, but if the NBN Co project changes yet again at the whim of a Government, Telstra has to protect the interests of its shareholders.

- The maintenance question is most easily solved by transferring the asset and associated staff and outsourced maintenance contracts, to NBN Co.

- But a simple outright transfer of ownership at the time the exchange lines are cut is not in the interests of Telstra shareholders. What happens if NBN Co becomes bankrupt?

- The issues of control and ownership of the Telstra asset and the transfer of maintenance liability are central to this deal.

- Telstra always had the option to remove the copper and sell the scrap for around $7,000/tonne. They get to be compensated for both that amount and the time value of the money while the asset is in use. This will be quite expensive for Mr Turnbull, expect this number to be hidden or declared "Commercial In Confidence".

Quotes [from SMH piece]

What was more interesting however was a sign that Telstra is close to inking a new deal to co-operate with the Abbott government’s revised broadband rollout – one that could underwrite more cash returns to shareholders in years to come.

The headline news in the Telstra Annual Report is that Data and "Network and Applications Services" (NAS) are the new high-growth areas. Telephony is in solid and increasing decline and Mobile seems to have peaked and is maintained a modest growth rate.

Sol Trujillo's advice to Howard in 2005 has been proven to be absolutely correct: the business was in meltdown and could only be saved by focussing on Fixed Data, or an NBN.

See the Share Price discussion and graphs below. Telstra's lowest price was immediately prior to their announcement of the Definitive Agreements with NBN Co.

Telstra’s share price has more than doubled from a low of $2.56 in November 2010 partly because Thodey has done a good job running the company, but it has also gone up because Telstra is a dividend-yield market darling.Ziggy Switkowski is not a good CEO, especially not of Telecomms firms. Not only did he leave Telstra's accounts in a shambles, $5billion of his acquisitions were later written off, his lack of action in performing necessary reorganisations and completely ignoring the collapse of Telephony and the urgent need to roll-out high-speed Fixed Data were compounded by his

It also confirms what Switkowski has been saying since he stepped in as chairman of NBN Co late last year. Telstra won’t get a windfall payment for its copper network, because the copper is already a stranded asset. [emphasis added]

As above, the Copper C.A.N. might become stranded, but Turnbull is unable to fulfil his plan without it. Thodey and his team can ask what the like and Turnbull has to smile and take it. While there is an obligation on the Government to honour its election commitment to "keep Telstra whole", the Telstra management feel duty-bound to extract the best deal they can for their shareholders. This is a radically asymmetrical bargaining position, one that outrageously favours Telstra. Alan Kohler wrote about exactly this predicament for Turnbull in 2012, calling plans for an FTTN a 'fantasy'. Time to say "I told you so"?

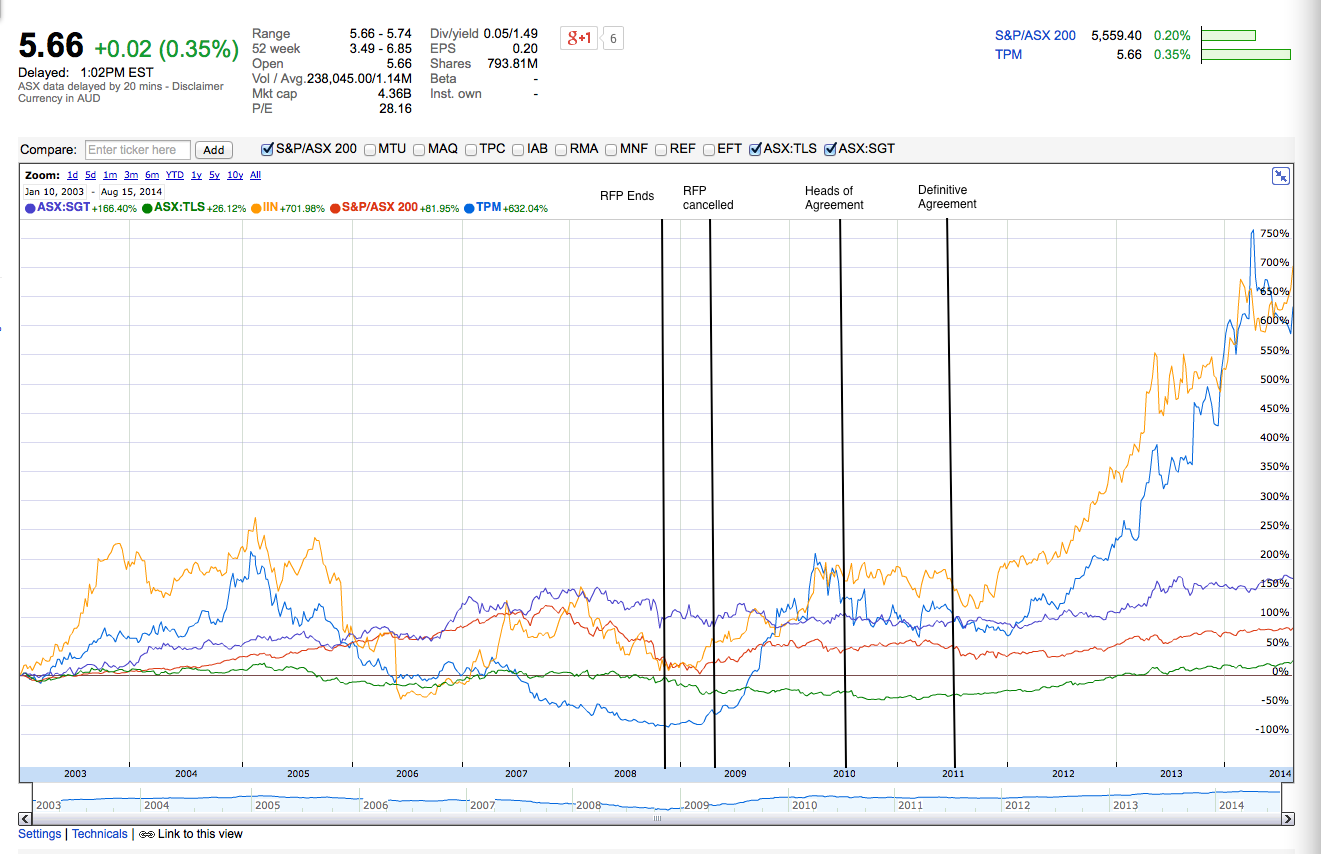

The key milestones, noted in the attached graphs, were:

- The Rudd/Conroy tender (RFP, Request For Proposal) for a $4.7B FTTN NBN, as pitched in 2005 by Sol Trujillo to Howard et al. The tender closed at the end of November, 2008. The Telstra proposal was iconically brief and dismissed by the independent review panel as non-compliant. It didn't address local supplier issues.

- In April 2009, Rudd/Conroy announced the tender was cancelled under advice from the Expert Panel (none of the non-Telstra tenders were considered viable) and instead of an FTTN, their best advice was to build an FTTP-based NBN.

- By June 2010, Telstra and NBN Co has signed a Financial Heads of Agreement. A non-binding statement of intention.

- In June 2011, Telstra and NBN Co signed Definitive Agreements, binding contracts binding both parties.

Share Price

Until last night, I would've said Telstra (TLS) and Optus (SGT, or SingTel) were good Telecomms stocks. But compared to the businesses leveraging the NBN, they are running dead.

Alan Kohler in his daily graphs yesterday, showed the share price growth of the two leading ISP's, TPG and iiNet, and the main Telcos, Optus and Telstra, then showed them together. Those graphs are unavailable and the public share price information does not produce the "30-bagger" (3,000%, yes, 30 times) growth quoted by Kohler.

iiNet and TPG have outperformed the ASX-200 by about 10 times since the public data series began.

Telstra may be at a 12-year high, but its share price is now only 20% above its 2003 value, while Optus/Singtel is around 175% higher. As a benchmark, the ASX-200, even after the problems of the GFC, is up 80% compared to 2003.

Telstra may be a "yield darling", but it's not been a long-term growth stock. The share market is an independent and unprejudiced assessor of the commercial value of a business, including its future prospects. While the current outlook for Telstra is good, as show by the steadily increasing valuation, the legacy of the under-investment and poor business decisions of Howard and the mismanagement by Ziggy Switkowski especially is still washing through.

The incomprehensible business decisions by Howard and his Cabinet, including Turnbull, to not support Trujillo in building an NBN and to not structurally separate Telstra before the final "T3" float continues to drag-down this company and create legislative and commercial nightmares within Australian Telecomms Sector.

I think David Thodey is an exceptional talent and will setup the company very well for the next 3-4 decades. But no, I'm not a shareholder of theirs.

The Google Finance links used are:

TPG vs iiNet, TLS vs SGT and TPG, iiNet vs TLS, SGT.

The effect of the NBN on Telecoms Companies

Included at the end are the graphs for Telstra's performance from the time it was fully privatised ('T3' float, 06-Oct-2006) to when the NBN Definitive Agreements were signed. There was a two to three year period when the share price was in free-fall.

As nothing else changed in the Commercial or Political world, but Telstra's share-price, the estimate by the Stock Market of the Net Present Value of all its future earnings, it's reasonable to attribute the recovery in Telstra and Optus (Singtel) shares to the NBN and only the NBN. The point of recovery of the Telstra share-price was around April when the Agreements were announced as proceeding.

The effect of the NBN on Telecoms Companies

Included at the end are the graphs for Telstra's performance from the time it was fully privatised ('T3' float, 06-Oct-2006) to when the NBN Definitive Agreements were signed. There was a two to three year period when the share price was in free-fall.

As nothing else changed in the Commercial or Political world, but Telstra's share-price, the estimate by the Stock Market of the Net Present Value of all its future earnings, it's reasonable to attribute the recovery in Telstra and Optus (Singtel) shares to the NBN and only the NBN. The point of recovery of the Telstra share-price was around April when the Agreements were announced as proceeding.

|

| Telstra vs Optus/Singtel |

|

| iiNet vs TPG |

|

| iiNet and TPG vs Telstra and Optus |

|

| Telstra vs ASX-200 from T3 float, 06-Oct-2006, through the GFC to 24-Jun-2012, NBN Definitive Agreements |

|

| Telstra vs ASX-200 from July 2009 (post GFC) to 24-Jun-2012, NBN Definitive Agreements |

No comments:

Post a Comment